First 5 Reasons Balance Transfer & Top-Up Loan are Best!-GANESH BRIJESH CAR LOAN

Even then you can get upto 200% loan on your car valuation

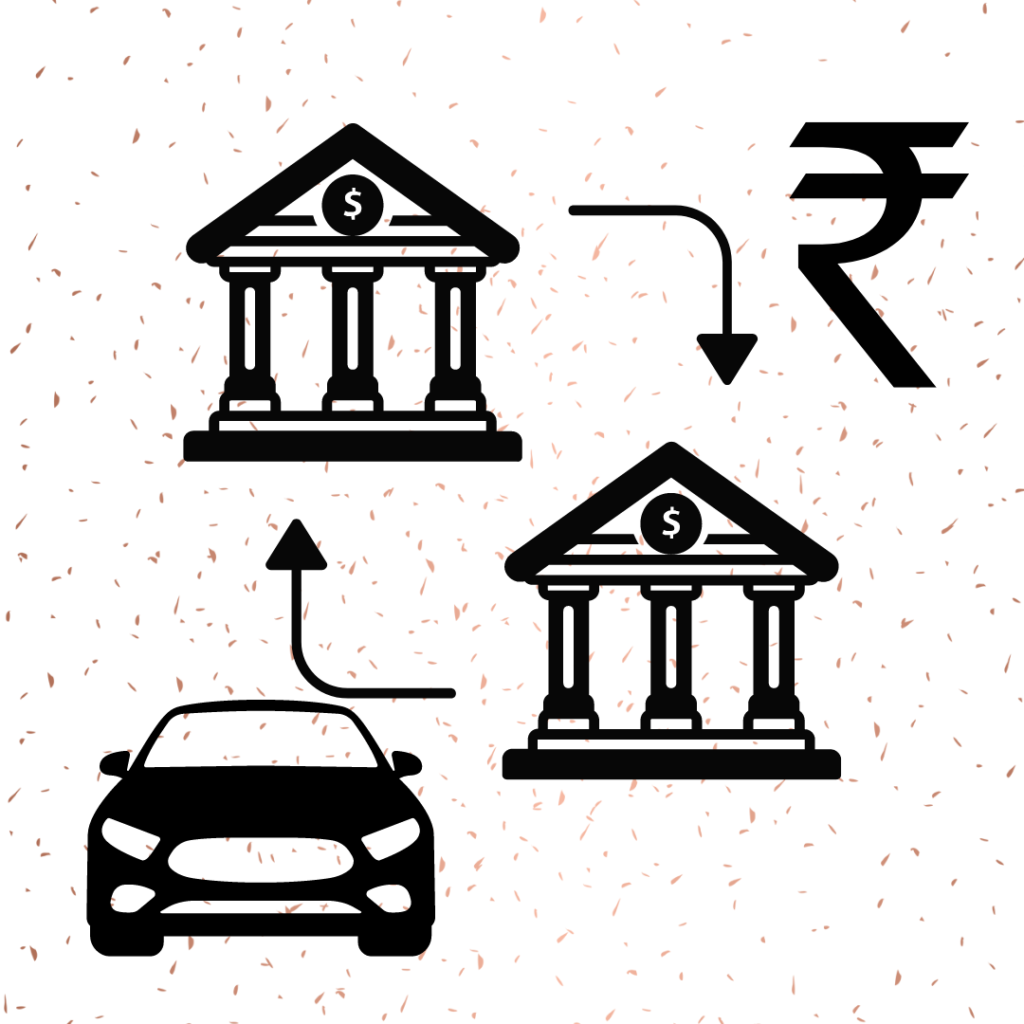

A loan balance transfer is one type of process. You transfer your loan balance to another bank or NBFC at a lower interest rate.

A top-up loan is one in which you can borrow more money on top of your existing loan.

We can reduce the interest rate by taking a loan at a low interest rate. Can meet financial needs by getting more money. More services and long-term loans can be available. You can get various offers and services through the bank. In this way, you can easily meet your financial needs through balance transfer and top-off.

Quick and Convenient process

Flexible Loan Amounts

Collateral Based loan

Maximum loan Amount on your car valuation

Affordable interest Rates

Documents Required for: Balance Transfer And Top up Loan

from Ganesh Brijesh Car Loan you need to submit the following documents for processing your application.

For Salaried

- RC Book Copy

- Passport size photos

- Aadhar card

- Pan card

- Light Bill / Vera Bill

- Last 6 Month Bank statement

- Last 3 month salary slip OR Salary Certificate/ Form 16

- Insurance Copy

For Self- Employed

- RC Book Copy

- Passport size photos

- Aadhar card

- Pan card

- Light Bill / Vera Bill

- Last 6 Month Bank statement

- Last 2 year ITR Copy

- Insurance copy